Approx. read time: 12.4 min.

Post: Unlocking Financial Freedom: The Ultimate Guide to Generating Residual Income

Unlocking Financial Freedom: The Ultimate Guide to Generating Residual Income

Understanding Residual Income

At its core, residual income is the money that keeps flowing into your bank account long after the initial effort has been expended. Unlike traditional income, which requires ongoing work (such as a salary or hourly wage), residual income continues to generate returns after the foundational work is done. This concept is powerful and has broad applications across personal finance, corporate finance, and various investment strategies.

For instance, an author who writes a book only once but continues to earn royalties from book sales years later is benefiting from residual income. Similarly, a company that invests in machinery may see profits long after the initial cost of the machinery is paid off. In both cases, residual income allows for ongoing earnings without a corresponding ongoing effort.

In today’s fast-paced economy, residual income represents more than just financial gain—it represents freedom. Whether you’re looking to build wealth or simply secure a more flexible lifestyle, learning how to create and maximize residual income is a critical component of your financial strategy.

Residual Income in Personal Finance

In the realm of personal finance, residual income is like the secret sauce to achieving financial well-being. Imagine not having to clock in extra hours at a job or take on side gigs, yet still seeing your bank balance grow. This is the beauty of residual income—it works for you long after you’ve stopped actively working for it.

Example: Consider investing in dividend-paying stocks. When you purchase shares in a company, you essentially become part-owner of that business. As long as the company is profitable and chooses to distribute its profits, you’ll receive a portion of these profits in the form of dividends. The best part? You only have to buy the stock once. From then on, as long as you hold those shares, you’ll continue to receive dividend payments. It’s like planting a tree that continues to bear fruit year after year with minimal effort on your part.

Another example is rental income from real estate. Once you’ve purchased a rental property and found tenants, you can collect rent on a regular basis. While there may be some ongoing management required, such as property maintenance or addressing tenant concerns, the income largely continues to flow without direct daily effort. Real estate is one of the most popular ways to generate residual income, and with the right strategy, it can become a highly lucrative venture. Learn more about how to get started with real estate investing.

Pro Tip: Always conduct due diligence before jumping into real estate. Make sure to research the local market, consider the costs of maintenance, and calculate your expected return on investment. Tools like the Zillow Rent Affordability Calculator can help you determine what potential rental income you might generate.

Residual Income in Corporate Finance

In the corporate world, residual income takes on a slightly different meaning. Here, it’s used as a performance metric to evaluate the profitability of a company beyond the required rate of return for shareholders. In essence, residual income in corporate finance measures the amount of profit that remains after a company has met its cost of capital.

This metric is crucial for investors and business leaders because it provides a more accurate picture of a company’s true profitability than traditional net income. By considering the cost of capital, residual income helps identify whether a company is generating enough profit to justify its investments.

Example: Imagine a company invests $10 million in a new manufacturing plant. After operating costs, taxes, and other expenses, the plant generates $12 million in profit. The company’s cost of capital for this investment is $1 million. Therefore, the company’s residual income from the plant is $1 million ($12 million profit – $1 million cost of capital). This is the true measure of the plant’s success, indicating that the investment has not only covered its costs but also created additional value for shareholders.

Companies with high residual income are often more attractive to investors because they demonstrate the ability to generate wealth beyond their operational expenses and capital costs. Learn more about how residual income works in corporate finance with this Corporate Finance Institute guide.

How Residual Income Works Its Magic

Whether you’re looking to pad your personal wallet or gauge a company’s financial health, understanding how residual income works is crucial. It’s all about recognizing opportunities where you can generate income that continues to flow over time without requiring your constant involvement.

The beauty of residual income lies in its ability to compound. As your initial efforts or investments bear fruit, they can create multiple streams of income that grow over time. With the right strategy, these streams can become substantial enough to support your lifestyle, allowing you to focus on other things you enjoy.

Generating Personal Residual Income

There are numerous ways to generate residual income. Some require an upfront investment of time, effort, or money, but the rewards can be substantial. Here are a few popular methods to consider:

- Dividend-Paying Stocks: By purchasing shares in companies that distribute a portion of their profits to shareholders, you can create a steady stream of residual income through dividends. The more shares you own, the larger your dividend payments will be. Many investors choose dividend stocks as a way to generate passive income for retirement. For a list of top dividend-paying stocks, check out this guide.

- Real Estate Rentals: Purchasing a rental property can generate monthly income from rent. After covering mortgage payments, maintenance, and other expenses, the remainder becomes your profit. Real estate is often considered one of the most stable ways to generate residual income, especially in high-demand areas.

- Royalties: Creators of intellectual property—whether books, music, software, or patents—can generate residual income through royalties. For example, an author may write a book once but receive royalties for years as it continues to sell. Similarly, a musician might earn royalties every time their song is streamed or purchased. Learn how to start earning royalties with resources like TuneCore for musicians and Amazon Kindle Direct Publishing for authors.

- Peer-to-Peer Lending: By lending money to individuals or small businesses through platforms like LendingClub or Prosper, you can earn interest payments on the loans. This type of investment requires minimal ongoing effort once the loan is made.

- Affiliate Marketing: If you have a blog, website, or social media presence, affiliate marketing can generate residual income. By promoting products or services and earning a commission on sales made through your referral links, you can create an income stream that continues as long as your content remains relevant. Platforms like Amazon Associates and Shopify offer affiliate programs that make it easy to get started.

The key to building personal residual income is diversification. Instead of relying on a single source of income, consider developing multiple streams. This not only increases your overall income but also reduces risk. If one stream dries up, you’ll still have others to rely on.

Pro Tip: Always start with what you’re passionate about. If you enjoy creating digital content, focus on online courses, books, or apps. If you love real estate, start with a small rental property. The more you enjoy the process, the more likely you’ll stick with it and see long-term success.

Residual Income in the Corporate World

In the corporate world, residual income serves a more strategic function. It helps businesses evaluate how effectively they are using their capital to generate profits. This can guide key decisions, such as whether to reinvest in new projects, expand operations, or even scale back in certain areas.

Example: A tech company might decide to invest heavily in research and development for a new product. After the product is launched, it continues to generate revenue through sales, licensing, or subscriptions. If the company’s earnings exceed the cost of developing and maintaining the product, that excess profit is considered residual income. This number is crucial when deciding whether to pursue similar projects in the future.

High residual income indicates that a company is using its capital efficiently, which makes it more attractive to investors. Conversely, low or negative residual income suggests that the company’s investments may not be yielding sufficient returns. Learn more about the importance of residual income in business decisions with this Harvard Business Review article.

Residual vs. Passive Income: Clearing the Confusion

Although residual and passive income are often used interchangeably, they aren’t the same. Understanding the distinction is essential for anyone looking to build long-term financial security.

Residual Income: Residual income refers to earnings that continue after the initial effort has been expended and after all related costs have been paid. For example, if you own a rental property, the rent collected after covering your mortgage, taxes, and maintenance expenses is residual income.

Passive Income: Passive income is a broader category that includes any income earned with little to no active effort on your part. This could be from dividends, interest, royalties, or even a business that operates independently of your involvement. While all residual income is passive, not all passive income is residual. For instance, interest earned on a savings account is passive but not residual, as it doesn’t account for operating expenses.

Example: You might invest in a stock that pays dividends (passive income) and at the same time own a rental property that provides income after expenses are paid (residual income). Both streams of income require minimal effort after the initial setup but have different levels of involvement and return.

For a deeper dive into the differences between residual and passive income, check out this Investopedia article.

The Road to Generating Residual Income

Building residual income is a journey that requires careful planning, commitment, and patience. Whether you’re investing in financial instruments, real estate, or creating a digital product, the key is to start. Over time, your efforts will compound, and the income you generate will become increasingly passive.

Here are some actionable steps to get you started on your journey to residual income:

- Identify Opportunities: Consider what skills, assets, or capital you have available. Are you creative? Invest in creating digital products. Do you have savings? Consider dividend-paying stocks or real estate.

- Start Small: Don’t feel like you need to make a massive investment upfront. Start small and scale over time as you gain more confidence and experience.

- Educate Yourself: Take time to learn about different residual income opportunities. Whether it’s through books, courses, or online articles, the more informed you are, the better decisions you’ll make. Here’s a great resource to get you started.

- Diversify: Don’t rely on just one source of residual income. Spread your investments across multiple areas to reduce risk and increase your chances of success.

Pro Tip: Don’t overlook the power of automation. Use tools like social media schedulers, autoresponders, and investment automation platforms to help manage your income streams with minimal effort.

Why Residual Income Matters

Residual income is more than just extra cash; it’s a fundamental component of a sound financial strategy. It provides a safety net, reduces financial stress, and opens up opportunities for growth and investment. By creating streams of residual income, you can take control of your financial future and reduce your reliance on a traditional paycheck.

Imagine being able to travel, spend time with family, or pursue hobbies while still generating income. This is the freedom that residual income can offer. It’s about creating a life where you’re not perpetually tied to a job, where financial independence isn’t just a dream, but a tangible reality.

Calculating Your Residual Income

Knowing how to calculate your residual income is crucial for both personal finance and business decisions. For individuals, the formula is relatively simple: Residual Income = Income – Expenses. For businesses, the calculation involves more complex factors, such as net income and the cost of capital. Understanding these figures will help you make informed financial decisions, from everyday spending to long-term investments.

Example: Let’s say your monthly income is $5,000, and your monthly expenses (including mortgage, bills, groceries, etc.) are $3,500. Your residual income would be $1,500, which can then be reinvested into generating more income or used for personal savings.

The Bottom Line

Residual income is the key to long-term financial freedom and stability. It enables you to build wealth while reducing your dependence on active income from employment or running a business. By creating multiple streams of residual income, you can make your money work for you rather than the other way around.

So, why wait? Start exploring ways to build your residual income streams today. Whether you’re investing in real estate, creating digital products, or exploring dividend stocks, the path to financial independence starts with a single step. Let your money plant seeds that will grow into a thriving garden of income, providing you with financial security for years to come.

FAQs

- What’s the easiest way to start generating residual income?

- There’s no one-size-fits-all answer, but investing in dividend-paying stocks or starting with a small rental property are accessible entry points for many. If you’re just starting, consider creating a simple digital product, such as an eBook or online course, that can be sold repeatedly without requiring ongoing effort.

- Is residual income truly passive?

- Residual income can be passive, especially after the initial work or investment. However, some streams, like rental income, may require ongoing management. The key is to automate or delegate tasks wherever possible to minimize your involvement.

- How much money do I need to start generating residual income?

- This varies widely. Peer-to-peer lending can start with a few hundred dollars, while real estate requires a more substantial upfront investment. It’s important to start with what you can afford and gradually scale up over time.

Remember, building residual income is a marathon, not a sprint. Patience, persistence, and informed decisions are your best companions on this journey to financial freedom. Start small, scale gradually, and before you know it, you’ll be reaping the rewards of your efforts. For more insights on building residual income streams, check out this comprehensive guide.

Related Videos:

Related Posts:

The Secrets of Building Wealth: What Took Me 10 Years to Learn, I’ll Teach You in One Minute

How do I create money online using WordPress?

Directory Listing Batch Script

Freedom Mobile hit by data breach,15,000 customers affected

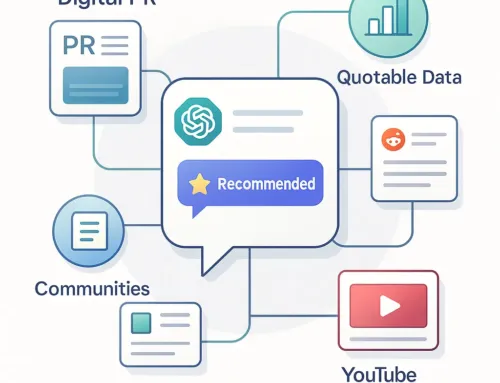

Get ChatGPT to Recommend Your Business: 4 Proven Plays

Rising from the Ashes: Why I Chose to Rebuild Myself Through Advocacy

5 Powerful Steps to Cut Off Toxic Parents While Honoring Yourself

Kingston Police’s Drone Surveillance for Distracted Driving Sparks Legal and Privacy Concerns

The Rise of Human Stupidity and Its Impacts